Getting Started with Investing in Wholesaling

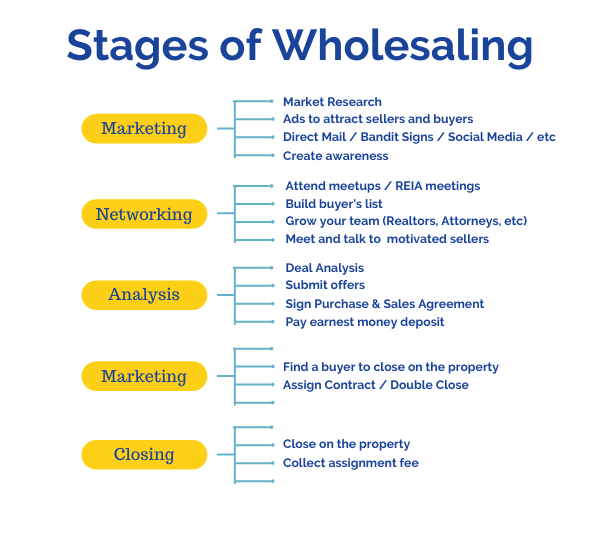

Beginners can enter property investment affordably through real estate wholesaling. The approach centers on negotiating discounted contracts and transferring them to end buyers for a fee. Wholesalers minimize upfront capital requirements and eliminate long-term management expenses by flipping contracts. Investing in wholesaling hones skills in market analysis, negotiations, and deal structuring. Rapid transaction timelines often lead to immediate profits rather than waiting for property appreciation. Maintaining a vetted list of investors prepared to purchase contracts is essential for smooth assignments. Consistency and integrity in negotiations foster long-term relationships and business momentum.

Benefits of Investing in Wholesaling

Wholesaling demands far less initial investment than purchasing rental properties or rehabs. Wholesaling provides a fast turnaround, often resulting in profits within weeks instead of years. Wholesaling teaches negotiation, deal evaluation, and network building useful across the property sector. By avoiding property ownership, wholesalers evade landlord responsibilities such as maintenance and tenant management. Wholesaling fosters relationship building with agents, attorneys, and investors, expanding professional networks.

Profits from assignments can be reinvested into bigger projects. Reliable cash flow from assignments aids in effective budgeting and planning. This model helps preserve working capital, preventing the cash shortages that rental properties sometimes incur. One-time gains from wholesaling usually involve simpler reporting compared to regular rental revenue. Joining experienced investor circles provides invaluable insights and exclusive lead sources. Digital marketing and CRM tools can further enhance lead generation and follow-up efficiency. Partnering with educational platforms like WholesalingHousesInfo.com real estate investing blog for beginners deepens your understanding of best practices and market trends.

Discover more about investing in real estate wholesaling, visit: how to start wholesaling

Tools & Resources for Wholesalers

A robust CRM system centralizes leads and automates follow-ups, ensuring no opportunity slips through the cracks. Lead-generation software can scrape public records and online listings to uncover motivated sellers quickly. Built-in calculators break down after-repair value, renovation budgets, and wholesale margins in seconds. Electronic signing tools allow sellers and buyers to finalize documents instantly from any device. Automated marketing platforms send drip campaigns that keep your name top-of-mind with motivated sellers. Secure closing portals let you monitor title searches, lien releases, and closing statements in one place. Online real estate communities and local meetups match you with active investors ready to close quickly.

Consistently leveraging these tools transforms complex workflows into streamlined processes, letting you focus on negotiation and scaling your business.

Getting Started: Actionable Steps for New Investors

Start with thorough market research, analyzing comparable sales and emerging growth areas within your region. Use targeted postcards, Facebook ads, and Craigslist posts to attract distressed homeowners looking for quick solutions. Develop a simple contract template with an assignment clause, reviewed by a real estate attorney to ensure legal compliance. Practice your pitch and negotiation scripts with peers or mentors to refine your communication skills. Build your investor database through local meetups, LinkedIn outreach, and referrals from industry contacts. Automate lead responses and drip campaigns so that no prospect goes unattended. Submit your inaugural purchase proposal, monitor conversion rates, and refine your strategy with each assignment.

Navigating Challenges in Real Estate Wholesaling

Overestimating property values or ARV can lead to unprofitable deals—always verify numbers with multiple comps. Ignoring renovation budgets can turn a profitable contract into a loss—obtain accurate repair quotes upfront. Insufficient buyer contacts delay closings—focus on expanding and nurturing your investor database. Poor follow-up habits result in lost leads—implement automated reminders to maintain consistent communication. Neglecting legal review of your contract templates can expose you to risk—always consult a real estate attorney. Taking on excessive contracts without proper systems in place increases errors—grow your pipeline in manageable stages. Disregarding market signals results in missed opportunities—regularly update your approach based on current data.

Final Thoughts on Investing in Real Estate Wholesaling

Investing in real estate wholesaling empowers beginners to enter the property market with minimal capital and rapid returns. Honing expertise in identifying opportunities, calculating profits, and closing assignments sets you apart in the market. Adopting technology for lead management, profit calculations, and follow-up streamlines your operations. Continuous education, ethical practice, and network expansion fuel long-term credibility and deal flow. Launch your first contracts, learn from each outcome, and deploy assignment fees to grow your wholesale enterprise. By staying disciplined and adaptable, wholesaling can evolve into a powerful pillar of your real estate endeavors.

Begin today, tap into expert guidance via what is wholesaling real estate, and build a thriving wholesaling business.